Serious revelations have emerged that Dialog Finance PLC, a subsidiary operated by Dialog Axiata PLC, is exploiting consumers by charging exorbitant interest rates through its ‘Genie App,’ in blatant violation of financial regulations and interest rate caps imposed by the Central Bank of Sri Lanka (CBSL).

It has caused utter dismay among economic experts and consumers alike that Dialog, positioning itself as the country’s premier telecommunications provider, is acting unlawfully through its financial arm (Fintech) in this manner.

The Crippling 45% Interest Rate

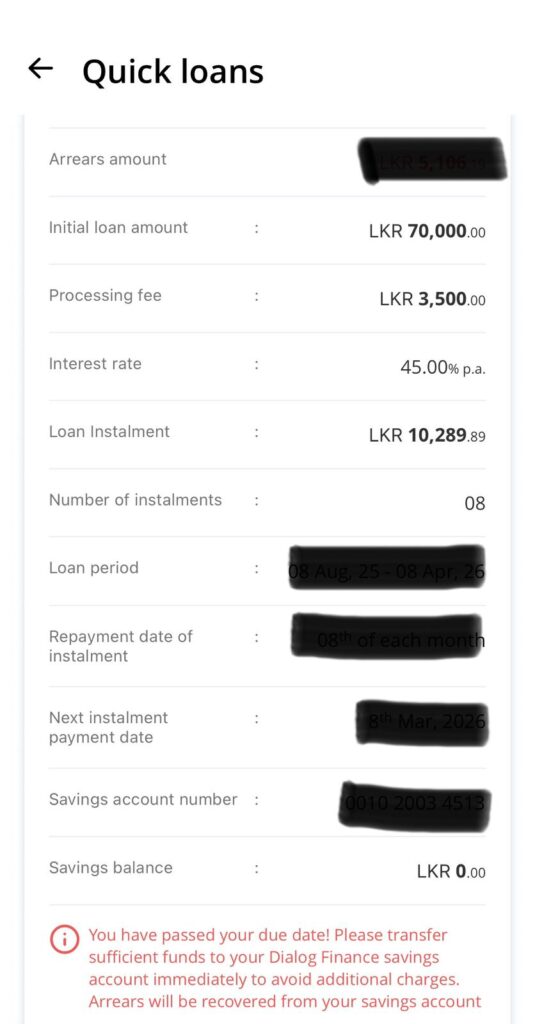

According to credible information and evidence (receipts) received by us, the annual interest rate charged for ‘Quick Loans’ provided through the Genie App reaches as high as 45% (45.00% p.a.).

For instance, for a loan of LKR 70,000, the company charges a processing fee of LKR 3,500. Under the 45% interest rate, the monthly installment is set at LKR 10,289.89. This is a mechanism that effectively entraps the general public in a debt cycle.

Defying Central Bank Directives

The Central Bank of Sri Lanka, under Monetary Law Act Order No. 01 of 2023 issued on August 25, 2023, has imposed maximum interest rate limits for banks and financial institutions. According to these directives, the maximum interest cap applicable, even for short-term loans, is stated to be 28%.

Despite this regulation, the fact that an institution holding a Licensed Finance Company status under the name Dialog Finance PLC is charging 45% interest—ignoring CBSL orders—is a direct challenge to the rule of financial law in the country.

Where Does the Money Go?

The gravest issue underlying this process is that these excessive profits do not remain within the country. A majority stake of 73.7% in Dialog Axiata PLC is held by Malaysia’s ‘Axiata Group Berhad’. Furthermore, another 10.36% stake is owned by India’s ‘Bharti Airtel Ltd’.

Accordingly, a vast portion of the wealth collected as 45% interest from unsuspecting customers in Sri Lanka is siphoned off to Malaysia and India as dividends. This constitutes a serious financial drain on the Sri Lankan economy.

Are Regulatory Authorities Asleep at the Wheel?

It is questionable why the financial supervision divisions of the Central Bank remain blind while such financial heists occur under the guise of digital technology. Do authorities, who strictly enforce the law on the common man, cower before multinational corporations?

Responsible authorities must immediately intervene to conduct an investigation into this matter, halt the charging of illegal interest rates, and ensure justice for consumers.